generation

accrued taxes

hiring an employee

in fractions of a second

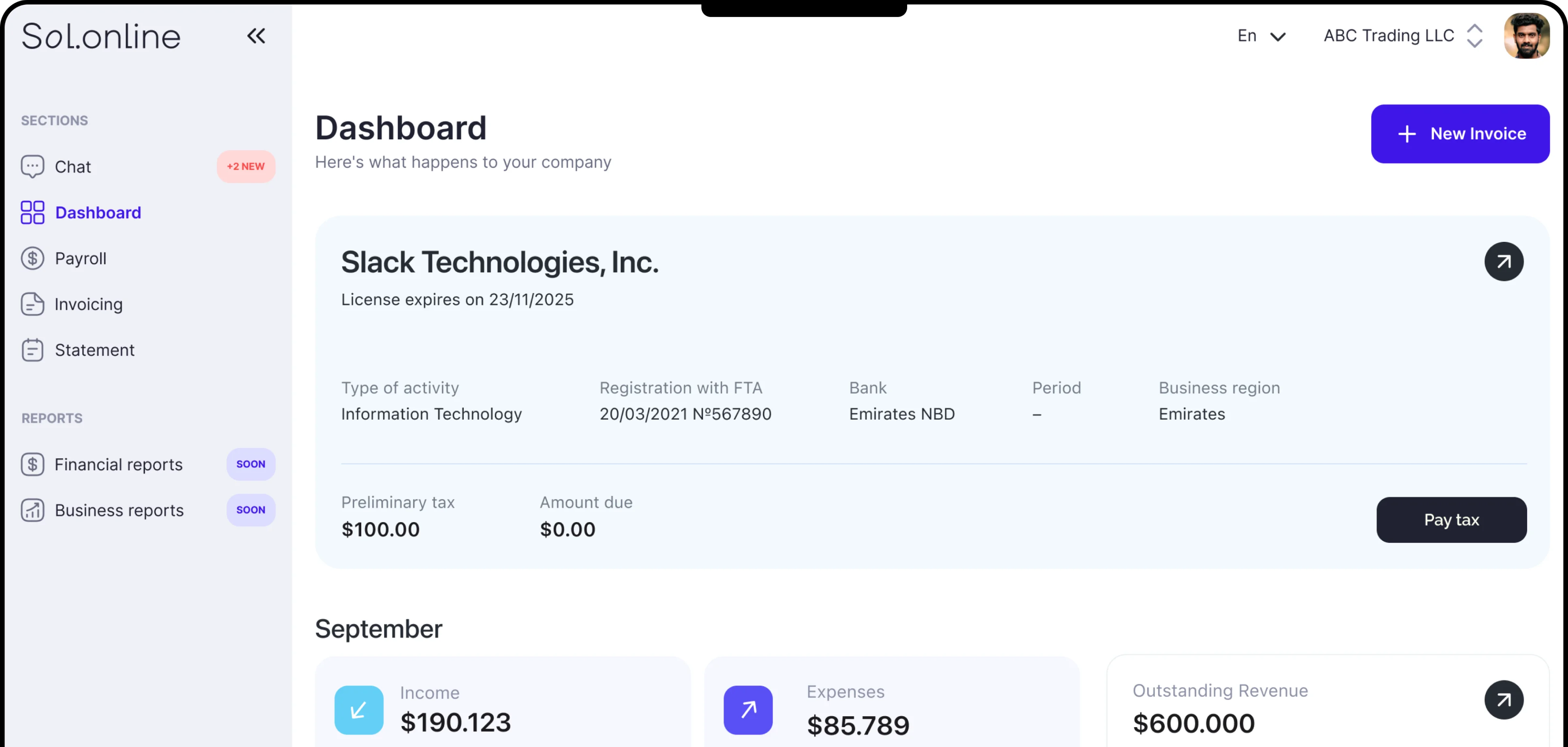

Our business is small. But as it turned out, we also need to register with the FTA, receive TRN numbers and pay taxes. Sol.online told us about this and registered it with EmaraTax. We express our deep gratitude to the managers!!! If it weren’t for them, our company would have to pay heavy fines for late registration

The main thing is that there is technical support in Russian. There were a lot of questions about my business, and I needed to restore my accounting records. Sol.online answered all my questions, I had export transactions and contracts in three currencies, the managers explained everything and set about restoring the accounting.

Finally, a really cool product like Sol.online has appeared on the market! I used another service, the money was withdrawn a lot, and technical support responded once a week. I subscribed to Sol.online, first for a trial version, and then subscribed for 1 year. I’m glad that there is a working service, with “live” technical support and for affordable money, thank you!

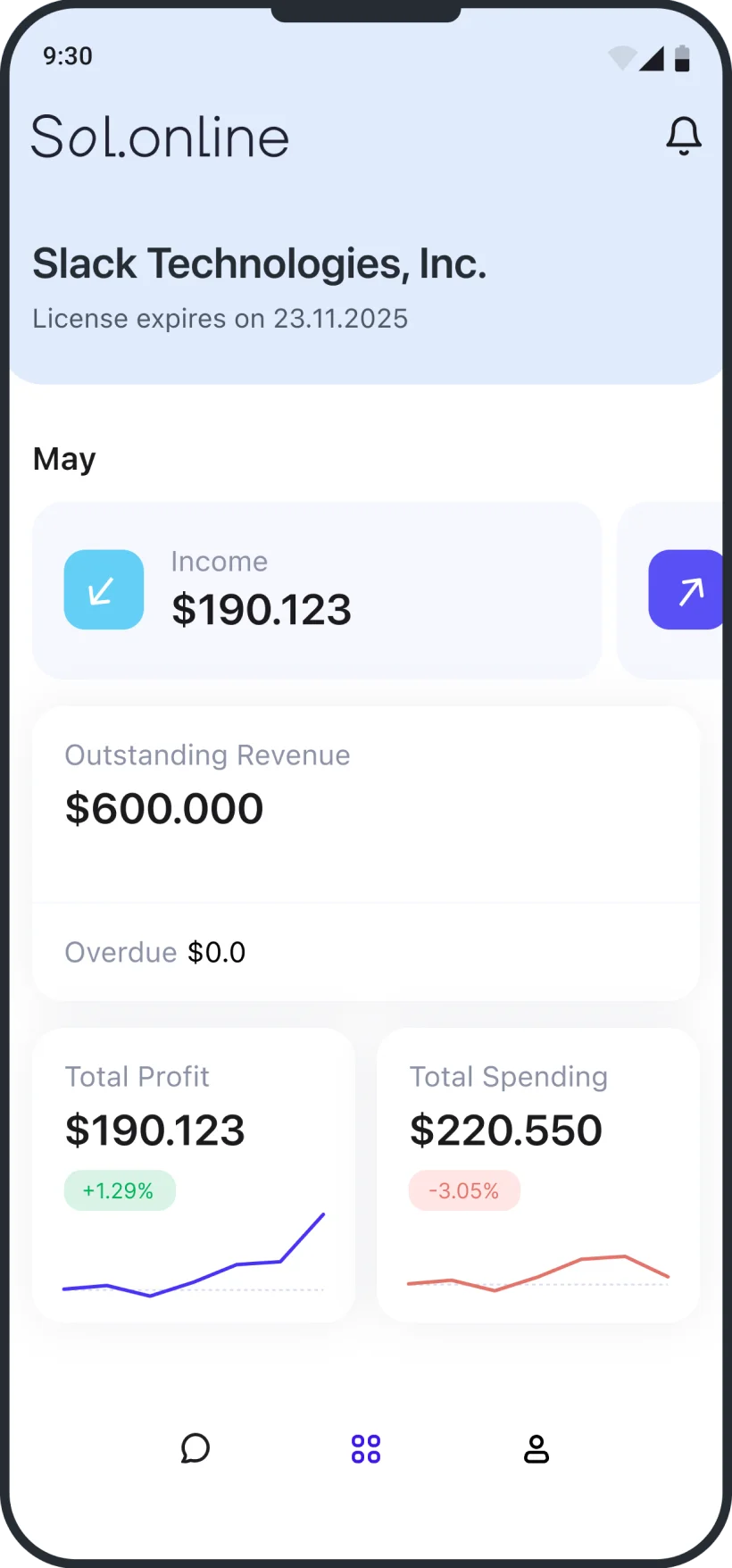

Simply enter the partner's information and specify their email address. The online software will generate the invoice in a matter of seconds.

The tax is calculated as the product of the tax rate on the net profit for the financial year. The rate of 0% applies to profits up to 375,000 AED, and the rate of 9% applies to amounts exceeding this threshold. Example: If a company earned a profit of 400,000 AED at the end of the financial year, it will be required to pay a corporate tax amounting to 2,250 AED. 375,000 * 0% + (400,000 - 375,000) * 9% = 0 + 25,000 * 9% = 2,250.

Yes, violations of the law are subject to sanctions in the form of fines and/or imprisonment. Violations such as non-payment of taxes on time, providing false tax returns, violating the deadline for submitting a declaration, failure to provide documents upon request, inability to maintain accounting records, and other types of violations are punishable. If the violation is deliberate or repeated, the amount of fines may increase and may exceed the amount of arrears by a multiple.